Check your insurance plan’s formulary to see which medications are covered and at what cost. Many plans list this information online. Compare this list with the medications you need. This helps you avoid unexpected bills.

Understanding Your Copay and Deductible

Familiarize yourself with your copay (the fixed amount you pay per prescription) and deductible (the amount you pay before your insurance kicks in). Canadian discount pharmacies often offer lower prices, potentially reducing your out-of-pocket expenses even after applying your copay.

Prescription Savings Programs

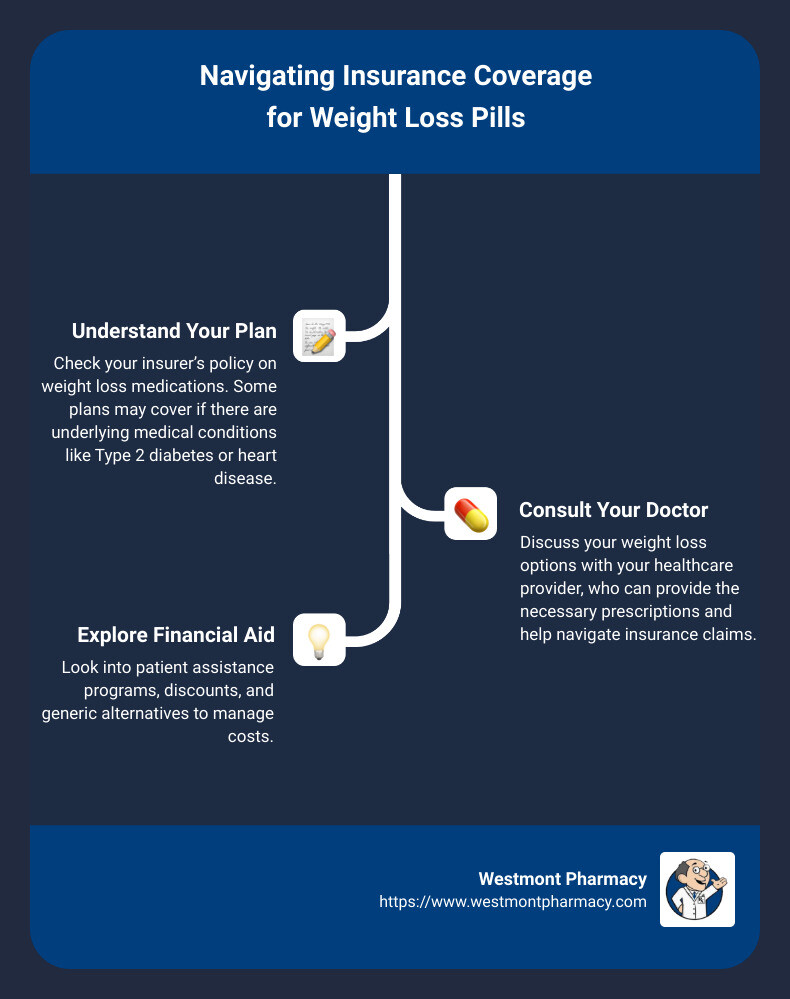

Many Canadian discount pharmacies partner with prescription savings programs. These programs offer additional discounts on medications not fully covered by insurance. Ask your pharmacist about available programs and their eligibility requirements. Don’t forget to check for manufacturer coupons; these can further decrease your costs.

Generic vs. Brand-Name Medications

Generic medications often cost significantly less than their brand-name counterparts and provide the same active ingredients and effects. Discuss generic options with your doctor. If your insurance covers generics, using them can dramatically cut your pharmacy bill. Your pharmacist can also advise you on options.

Utilizing Pharmacy Comparison Tools

Several online tools compare medication prices across different pharmacies. Use these tools to find the best price for your prescription, even factoring in your insurance coverage. Remember that the final price might change depending on your insurance plan.

Ask Your Pharmacist

Pharmacists are excellent resources! They can explain your insurance coverage and suggest ways to save money on your prescriptions. Don’t hesitate to ask questions–they are there to help you.